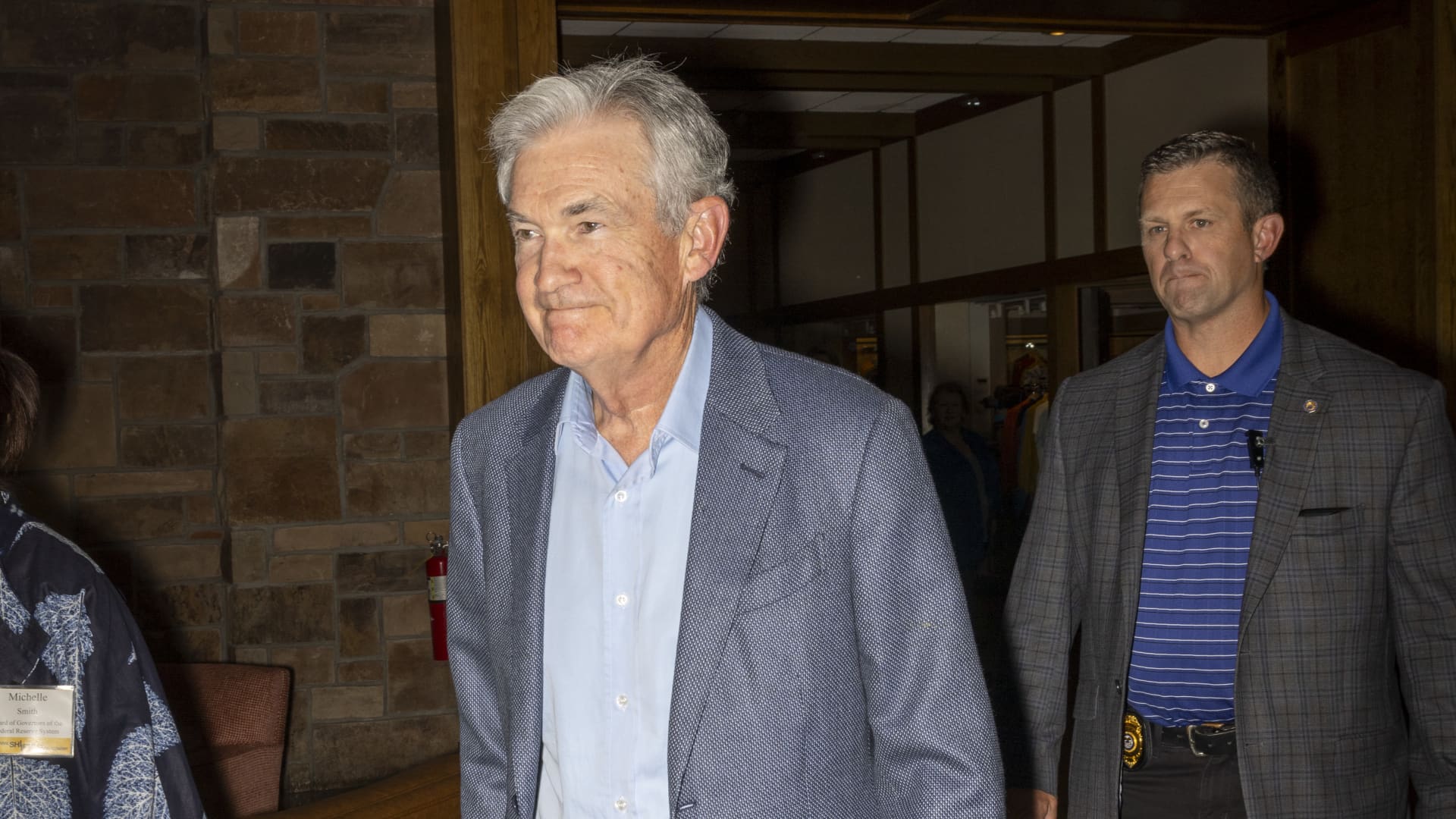

Jerome Powell, Chair of the Federal Reserve, arrives to a dinner at the start of the Jackson Hole Economic Symposium on August 24, 2023 at Grand Teton National Park near Jackson Hole, Wyoming.

Natalie Behring | Getty Images News | Getty Images

This report is from today’s CNBC Daily Open, our new, international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

Rally fizzles out

U.S. stocks closed lower Thursday as an earlier Nvidia-sparked rally fizzled out, while Treasury yields climbed higher. Asia-Pacific markets tumbled Friday. Japan’s Nikkei 225 lost almost 2%, dragged down by retail and technology stocks — like Softbank’s 3.1% fall. Meanwhile, Tokyo’s core inflation for August came in at 2.8%, lower than the expected 2.9% and July’s 3%.

Muted response to Nvidia

Nvidia shares inched up just 0.1% Thursday, paring earlier gains of as much as 8%. That’s despite the company reporting an astounding earnings beat Wednesday (though its automotive segment fell quarter on quarter because of lower electric vehicle demand in China). Nvidia’s results scared investors away from competitors as well: Shares of AMD slumped 7%, while that of Intel sank 4.1%.

Slow summer for shipping

In stark contrast with the pandemic when supply chains were snarled up, this summer’s been slow for shipping routes from Asia to Europe. As demand for goods slows and supplies remain high — because companies rushed to stock up after pandemic shortages — there’s just less demand for container ships, writes CNBC’s Lucy Handley.

India denies reliance on Russian oil

“India doesn’t get over dependent on anyone,” the country’s Minister of Petroleum and Natural Gas Hardeep Singh Puri told CNBC’s Tanvir Gill when asked if his country was too dependent on the Kremlin. “We are buying from 39 sources,” Puri added. As of May, Moscow accounts for about 40% of India’s crude imports.

[PRO] Non-AI market themes to play

Everyone knows artificial intelligence is behind the rally in the first half of this year. But there are other market themes that investors should know about, according to Goldman Sachs. The bank lists five “compelling” stocks to invest in — with two on its conviction list and one with a 60% upside.

The bottom line

Even Nvidia’s blockbuster earnings couldn’t quell investor anxiety over Jackson Hole.

Nvidia shares rose just 0.1% despite reporting a 422% year-over-year surge in net income. Perhaps investors, bursting with enthusiasm over the chipmaker, had already priced in the record revenue. Perhaps investors wanted to cash out early after Nvidia’s shares hit a record high earlier in the day — investors have been bracing for a bad August, and an even worse September, which is historically the worst month for stocks. Or perhaps investors were worried about Federal Reserve Chair Jerome Powell’s speech at Jackson Hole.

(To be clear, analysts still think Nvidia’s shares will pop in the long run. Rosenblatt increased its price target from $800 to $1,100, a new high among Wall Street analysts and an implied 133% upside from Thursday’s close. Big Wall Street banks like Goldman Sachs, Citi and Bank of America were more conservative than that, but still hiked their targets for Nvidia.)

Last year, the S&P 500 lost 2% in the five trading days before Powell’s Jackson Hole speech, and stumbled 5.5% in the five after, according to DataTrek Research. This time, investors are “worried about what [Powell] might say around r-star and embracing, high new normal rates,” said Krishna Guha, head of global policy and central bank strategy for Evercore ISI. R-star is the value at which interest rates neither stimulate nor restrict the economy. In other words, investors are concerned the Fed might not cut interest rates that much even after inflation subsides.

History, then, repeated itself. One day before Powell’s speech, stocks fell sharply. The S&P retreated 1.5% and the Nasdaq shed 1.87%, the biggest one-day loss since Aug. 2 for both indexes. The Dow Jones Industrial Average slipped 1.08%, its worst day since March. Technology stocks, because of their sensitivity to interest rates, were the biggest losers of the day: Amazon lost 2.7% and Apple dropped 2.6%. With just one week left before August draws to a close, it seems market sentiment isn’t likely to change soon, even with earth-shattering reports like Nvidia’s.

— CNBC’s Jeff Cox contributed to this report

More Stories

Orban challenger in Hungary mobilizes thousands at a rare demonstration in a government stronghold – Times of India

3 simple steps to fight ‘the Google effect’ and improve your memory recall

Generative AI will be designing new drugs all on its own in the near future